BMW Ventures Reports Strong Q3 FY26 Performance Driven by Significant Deleveraging and Growth in Business of Fabricated Steel Products

Feb 07, 2026

VMPL

Patna (Bihar) [India], February 7: BMW Ventures Limited (BSE: 544543, NSE: BMWVENTLTD), one of Eastern India's largest steel distributors and manufacturers of fabricated steel products, announced its financial results for Q3 FY26, highlighting a sharp rise in profitability, led by a significant reduction in interest costs following deleveraging from IPO proceeds and growth in the business of fabricated steel products. An Interim Dividend of Rs. 1.50 per equity share of face value of Re. 10/~ each for the financial year 2025-26 announced by the company.

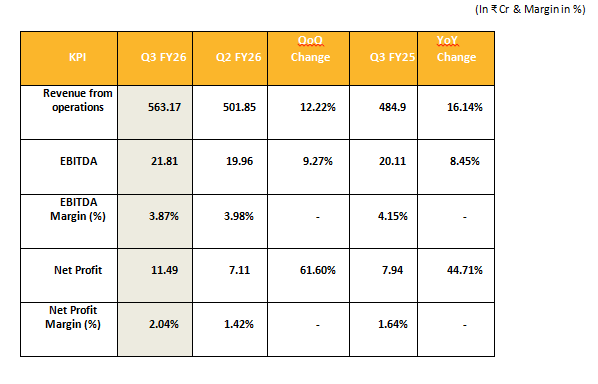

Key Financial Highlights

Key Financial Highlights - Q3FY26

- Revenue stood at ₹563.2 crore, registering 16.1% YoY growth and 12.2% QoQ growth, driven by steady demand and continued scale-up in fabricated steel products.

- EBITDA came in at ₹21.8 crore, reflecting 8.45% YoY growth and 9.3% QoQ growth, supported by resilient operating performance, better product mix and efficient inventory management despite elevated steel prices.

- Profit After Tax (PAT) surged to ₹11.5 crore, marking a sharp 44.7% YoY increase and 61.6% QoQ growth, primarily driven by a reduction in finance costs following deleveraging.

- An Interim Dividend of Rs. 1.50 per equity share of face value of Re. 10/~ each for the financial year 2025-26 announced by the company.

Deleveraging & Operational Resilience Driving Earnings Growth

The sharp improvement in profitability was largely driven by a meaningful reduction in interest costs following the utilisation of IPO proceeds for debt repayment, alongside improved inventory management. This deleveraging has materially strengthened the balance sheet and enhanced earnings quality, allowing operating profits to translate more effectively into net earnings.

Operational Resilience Amid Steel Price Volatility

Despite higher steel prices during the quarter, BMW Ventures maintained stable EBITDA margins, supported by:

- A growing share of fabricated steel products and a better product mix

- Strong distribution reach across Eastern India

- Efficient working capital and inventory management.

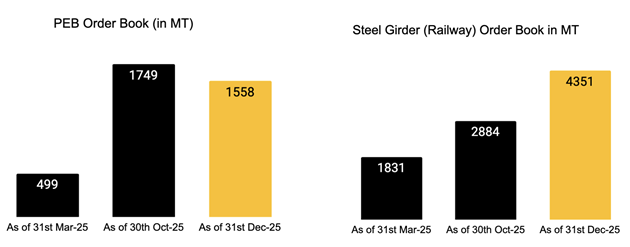

Fabricated Steel Products Order Book (In Metric Tons)

Management Perspective

Mr Nitin Kishorepuria, Managing Director, commented on their Q3 FY26 financial performance.

We are pleased to share another quarter of strong performance, with our net profit rising by 44.7% YoY, reflecting our operational discipline, efficient supply chain management, and strong dealer engagement across Eastern India. Despite the high volatility in steel prices, our diversified portfolio and long-standing partnerships have allowed us to beat our earlier guidance of 25-30% growth. The key highlight of the quarter is our deleveraging efforts, which led to a sharp rise in profitability, paving the way for more sustainable growth and a strengthened balance sheet.

Our strategic focus remains on expanding our footprint, leveraging our strong distribution network, and scaling high-potential manufacturing segments, such as pre-engineered buildings (PEBs) and steel girders, in our RDSO-approved facility. These initiatives not only diversify our revenue mix but also position us to capture opportunities arising from East India's rapid infrastructure expansion.

Looking ahead, we expect continued growth supported by government-led infrastructure investments and increasing steel consumption in Eastern India. With our deep-rooted market presence, robust product portfolio, and efficient working capital management, we are confident of sustaining a consistent growth trajectory while improving margins and return ratios in the coming quarters.

Way Forward

The company anticipates robust growth in FY26, driven by continued momentum in its fabricated steel product segments--particularly Pre-Engineered Buildings (PEBs) and Railway Steel Girders - as well as the execution of ongoing deleveraging initiatives.

Collectively, these growth drivers are expected to meaningfully strengthen earnings in FY26. Accordingly, we are revising our FY26 bottom-line growth guidance upward to 30-35%, from the earlier range of 25-30%, supported by improving margins and sustained top-line momentum.

With a strengthened balance sheet, reduced leverage, and a focus on higher-margin fabricated steel products, BMW Ventures is well-positioned to deliver sustainable earnings growth going forward. Management remains focused on disciplined capital allocation, margin stability, and expanding its presence across the infrastructure and construction-linked demand segment.

About BMW Ventures Limited

BMW Ventures Limited, with over three decades of operational experience, is one of Eastern India's largest steel distributors and manufacturers of fabricated steel products, including the fabrication of pre-engineered buildings (PEBs) and RDSO-approved steel girders.

Headquartered in Patna, the company operates six stockyards and caters to 29 districts across Eastern India through a robust network of 1,299 dealers. Its modern fabrication and manufacturing units collectively have an installed capacity of over 27,800 MT per annum, enabling it to serve diverse industrial, construction, and infrastructure clients efficiently.

Disclaimer

This document may contain certain forward-looking statements within the meaning of applicable securities law and regulations. These statements include descriptions regarding the intent, belief or current expectations of the Company or its directors and officers with respect to the results of operations and financial condition of the Company. Such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ from those in such forward-looking statements as a result of various factors and assumptions which the Company believes to be reasonable in light of its operating experience in recent years. Many factors could cause the actual results, performances, or achievements of the Company to be materially different from any future results, performances, or achievements. Significant factors that could make a difference to the Company's operations include domestic and international economic conditions, changes in government regulations, the tax regime, and other statutes. The Company does not undertake to revise any forward-looking statement that may be made from time to time by or on behalf of the Company.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL. ANI will not be responsible in any way for the content of the same.)